The allure of rapid riches often overshadows the steady, reliable path to wealth: long term investment. While get-rich-quick schemes promise instant gratification, they rarely deliver lasting financial security. In contrast, a well-thought-out, long term investment strategy, patiently implemented, offers a far more sustainable and predictable route to building a comfortable financial future. It’s about playing the long game, harnessing the power of compound interest, and weathering market fluctuations with a level head.

Key Takeaways:

- Long term investment focuses on consistent growth over extended periods, minimizing risk through diversification and patience.

- Compound interest is a powerful wealth-building tool, where earnings generate further earnings, accelerating growth over time.

- Understanding risk tolerance and aligning investments accordingly is crucial for successful long term investment.

- Regular portfolio review and adjustments are necessary to adapt to changing market conditions and personal financial goals.

Why Choose Long Term Investment for Secure Wealth Growth?

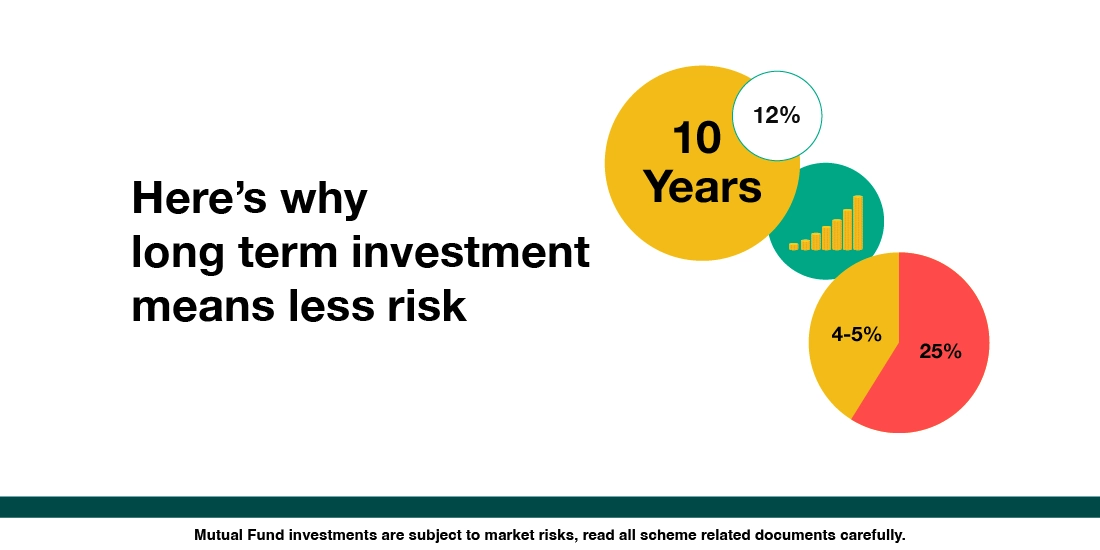

The beauty of long term investment lies in its ability to smooth out the volatility of the market. Short-term market fluctuations can be unsettling, but over the long haul, the overall trend of the market has historically been upward. By focusing on the long term, investors can avoid making emotional decisions based on short-term dips, which can often lead to losses.

Furthermore, long term investment allows you to take full advantage of compound interest. This is where your earnings generate further earnings, creating a snowball effect. The longer your money is invested, the more significant the impact of compounding becomes. Imagine investing a lump sum in your 20s and letting it grow untouched until retirement. The power of compounding over those decades can be truly remarkable.

Another benefit is that long term investment offers more flexibility in terms of investment choices. You have the time to explore different asset classes, such as stocks, bonds, real estate, and even alternative investments like commodities or collectibles. Diversification, or spreading your investments across various asset classes, is a key strategy for mitigating risk.

How Does Diversification Support Long Term Investment Goals?

Diversification is often touted as the cornerstone of any solid long term investment plan. It’s the practice of spreading your investments across different asset classes, industries, and geographic regions to reduce your overall risk. The logic is simple: if one investment performs poorly, the others may still perform well, cushioning the blow to your portfolio.

Think of it like this: don’t put all your eggs in one basket. If that basket falls, you lose everything. By diversifying, you’re essentially creating multiple baskets, so even if one falls, you still have the others to rely on. For example, you might invest in a mix of stocks from different sectors (technology, healthcare, consumer staples), bonds from different issuers (government, corporate), and real estate properties in different locations.

The optimal level of diversification will depend on your individual risk tolerance, investment goals, and time horizon. A younger investor with a longer time horizon might be comfortable with a more aggressive portfolio that includes a higher proportion of stocks, while an older investor approaching retirement might prefer a more conservative portfolio with a higher proportion of bonds.

Understanding Risk Tolerance in Long Term Investment Strategies

Risk tolerance is a critical factor to consider when building a long term investment portfolio. It refers to your ability to handle potential losses in your investments. Are you the type of person who can sleep soundly at night knowing that your portfolio might decline in value in the short term? Or do you tend to panic and sell your investments when the market takes a downturn?

It’s essential to be honest with yourself about your risk tolerance, as it will heavily influence the types of investments you choose. If you’re risk-averse, you might prefer lower-risk investments like government bonds or high-dividend stocks. If you’re more risk-tolerant, you might be comfortable with higher-risk investments like growth stocks or emerging market stocks.

Keep in mind that your risk tolerance may change over time. As you get older and closer to retirement, you might become more risk-averse as you have less time to recover from potential losses. It’s important to reassess your risk tolerance periodically and adjust your portfolio accordingly. A financial advisor can help you assess your risk tolerance and build a portfolio that aligns with your comfort level. They can also guide you with access to financial gb information.

Maintaining and Adjusting Your Long Term Investment Portfolio

Building a long term investment portfolio is not a “set it and forget it” exercise. It requires ongoing monitoring and adjustments to ensure that it remains aligned with your goals and risk tolerance. Market conditions change, your personal circumstances change, and your investment goals may evolve over time.

It’s a good idea to review your portfolio at least once a year, or more frequently if significant events occur that could impact your investments. During your review, assess your asset allocation to ensure that it still matches your risk tolerance. If your portfolio has become overweighted in one asset class, you may need to rebalance it by selling some of your holdings in that asset class and buying more of the underweighted asset classes.

Also, consider making adjustments to your portfolio as your life changes. For example, if you get married, have children, or change jobs, your financial goals and risk tolerance may shift. You might need to increase your contributions to your retirement account, adjust your asset allocation, or add new investments to your portfolio. Regular check-ins and adjustments are vital for ensuring that your long term investment strategy continues to serve you well over the years.